Income From Continued Operations Realized Gain on Income Statement

3.4 Statement of Income and Comprehensive Income

The income statement captures an entity's operating activities. As previously stated, net income is a measure of return on capital and, hence, of performance. This means that investors and creditors can often estimate the company's future earnings and profitability based on an evaluation of its past performance as reported in net income. Comparing a company's current performance with its past performance creates trends that can have a predictive, though not guaranteed, value about future earnings performance. Additionally, comparing a company's performance with industry standards helps to assess the risks of not achieving goals compared to competitor companies in the same industry sector.

As previously mentioned, all the core financial statements are based on accrual accounting. Accrual accounting, in turn, is based on a series of standards-based processes and estimates. Some of these estimates have more measurement uncertainty than others, and some estimates are inherently more conservative than others. This in turn affects the quality of earnings reported in an income statement.

Quality of earnings – the amount of earnings attributable to sustainable ongoing core business activities rather than to "artificial profits" arising from:

- differences in earnings due to applying the various accounting policy choices such as FIFO or weighted average cost for inventory valuation or straight-line, declining- balance, or units-of-production depreciation methods

- the use of estimates such as those for estimating bad debt or warranty provisions

- the presence of significant amounts of non-operating gains and losses compared to income from continuing operations

- the inclusion of unreliable items such as inappropriate contingent gains

- management bias and reported amounts not objectively determined

- differences due to IFRS or ASPE application of standards

- information that is not concise or clearly presented and is poorly understood, resulting in potential misstatement

Lower quality earnings will include significant amounts of the items listed. If the quality of earnings is low, more risk is associated with the financial statements, and investors and creditors will place less reliance on them.

It's very important to take one more look at the difference between other comprehensive income and accumulated other comprehensive income. These topics will be revisited in the Investments chapter later in this book however, the basics should be considered.

Other comprehensive income is an account that appears on the income statement. NOTE – in the Wellbourn example presented above, on the statement of comprehensive income, the account is listed as Unrealized gain from FVOCI investment. The unrealized gain is other comprehensive income. Be mindful of the difference in account names as that can be confusing to students.

As a straightforward explanation, the account (other comprehensive income) is used to adjust the increase or decrease in fair value of certain investments. A company can have a balance of either other comprehensive income or loss, depending on if the value of the investments increases or decreases. It's important to note that other comprehensive income is NOT included in the calculation of net income but is included in the calculation of comprehensive income (see the Wellbourn financial statements above). Recall that net income is ultimately closed to retained earnings. Since other comprehensive income is not included in the calculation of net income, other comprehensive income is closed to accumulated other comprehensive income.

Accumulated other comprehensive income is an accumulator account that is located in the equity section of a company's balance sheet. Accumulated other comprehensive income is the accumulation of any gains or losses on the change in fair value of certain investments. We will see in Chapter 8 (Investments) that when a company sells an investment, the accumulated other comprehensive income account will have to be adjusted. However, for the purposes of this chapter, normally a journal entry is not presented to close the other comprehensive income to accumulated other comprehensive income; similar to closing net income to retained earnings.

Single-step and Multiple-step Statement of Income

Single-step, multiple-step, or any condensed formats used in a statement of income are not specified GAAP requirements. Companies can choose whichever format best suits their reporting needs. Smaller privately held companies tend to use the simpler single- step format, while publicly traded companies tend to use the multiple-step format. When condensed formats are used, they are supplemented by extensive disclosures in the notes to the financial statements and cross-referenced to the respective line items in the statement of income.

The Wellbourn Services Ltd. statement of income, shown earlier, is an example of a typical single-step income statement. For this type of statement, revenue and expenses are each reported in the two sections for continuing operations. Expenses and losses are deducted from revenues and gains to arrive at net income. The term single-step comes from the single subtraction that is needed to arrive at net income, before discontinued operations. Income tax expense is usually reported separately as the last item before net income, before discontinued operations, to show its relationship to income before income tax.

Discontinued operations are separately reported below the continuing operations. The separate disclosure and format for the discontinued operations section is a reporting requirement and is discussed and illustrated below. The condensed or single-step formats make the statement simple to complete and keeps sensitive information out of the hands of competitive companies, but provides little in the way of analytical detail.

The single-step format is normally used for smaller, private companies while the multi-step format is often used in public companies.

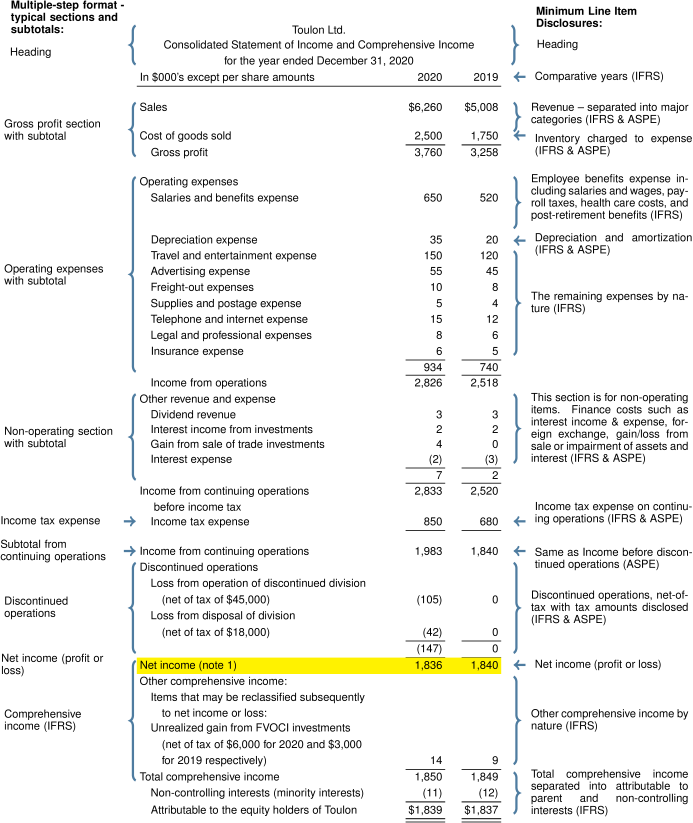

The multiple-step income statement format provides much more detail. Below is an example of a multiple-step statement of income for Toulon Ltd., an IFRS company, for the year ended December 31, 2020.

The other revenue and expenses section is to report non-operating transactions not due to typical daily business activities. For example, if a company sells retail goods, any interest expense incurred is a finance cost, and is not due to being in the retail business.

Toulon reported four non-operating items:

- Dividend revenue would be for dividends received from an investment in shares of another company

- Interest income from investments would likely be from an investment in bonds of another company

- Gain from the sale of trading investments would be for the profit made when the investment was sold. In this case, the investment is classified as fair value through net income (FVNI), which means any changes in the investment's fair value at each reporting date, or profit upon sale, are reported as a gain/loss in net income

- Interest expense would be any interest paid on amounts owed to various creditors. This is considered to be a financing expense and not an operating expense, unless the company is a finance company.

Other examples of non-operating items are listed below:

- write-down of inventory

- impairment losses and reversals of impairment losses on PPE, intangible assets, and goodwill

- foreign currency exchange gains or losses

- gain or loss from asset disposal or from long-lived assets

- reclassified as held for sale

- interest expense by current liabilities, long-term liabilities, and capital lease obligations

- unusual items (not typical and infrequent)

The multiple-step format with its section subtotals makes performance analysis and ratio calculations such as gross profit margins easier to complete and makes it easier to assess the company's future earnings potential. The multiple-step format also enables investors and creditors to evaluate company performance results from continuing and ongoing operations having a high predictive value compared to non-operating or unusual items having little predictive value.

Operating Expenses

Expenses from operations must be reported by their nature and, optionally, by function (IFRS). Expenses by nature relate to the type of expense or the source of expense such as salaries, insurance, advertising, travel and entertainment, supplies expense, depreciation and amortization, and utilities expense, to name a few. The statement for Toulon Ltd. is an example of reporting expenses by nature. Reporting expenses by nature is mandatory for IFRS companies; therefore, if the statement of income reports expenses by function, expenses by nature would also have to be reported either as a breakdown within each function in the statement of income itself or in the notes to the financial statements.

Expenses by function relate to how various expenses are incurred within the various departments and activities of a company. Expenses by function include activities such as the following:

- sales and marketing

- production

- office and administration

- research and development

Common costs such as utilities, supplies, insurance, and property tax expenses would have to be allocated between the various functions using a reasonable basis such as square footage or each department's proportional share of overall expenses. This allocation process can be cumbersome and will require more time, effort, and professional judgment.

The sum of all the revenues, expenses, gains, and losses to this point represents the income or loss from continuing operations. This is a key component used in performance analysis and will be discussed later in this chapter.

In contrast to the multi-step income statement, the single-step income statement is much easier to create. In a single-step income statement, only two main groupings are used: revenues and expenses. The statement begins with revenues and gains and then expenses and losses are deducted to calculate net income. Income tax is reported separately as the last item before net income before discontinued operations to show the relationship to income before income tax. The expression "single-step" comes from the single subtraction that is needed to arrive at net income before discountinued operations. A single-step income statement was shown earlier in the chapter.

The single-step income statement offers some advantages and disadvantages:

Advantages

- It offers a simplified snapshot of an entity's revenue and expenses. I.e., its simple format enables its reader a basic understanding of its affairs. The reader does not have to be a financial expert to get some meaning out of it.

- It covers most of the basic information. Thus, it can help in formulating a general view of the entity without performing deep analysis.

- The workload of accountants is reduced as this simplified approach makes record-keeping easier, and analyzing the figures also becomes easy.

Disadvantages

- The single-step income statement gives only a basic view of the entity for the period under consideration. Thus, it may not be useful enough for a person like an investor to make an appropriate decision.

- It lacks information about gross margin and operating margin data. Hence making it difficult to identify the source of most expenses, which will make it further difficult to make any future projections.

- It does not differentiate between primary activities, i.e., its core activities, and noncore activities. It treats them the same way, which may lead to misunderstanding.

In comparison, the multi-step income statement also has advantages and disavantages:

Advantages

- Offers greater detail to a user or stakeholder.

- Assists in better analyzing the financial performance and the general health of a company.

- Investors, creditors, and other stakeholders of interest monitor the gross margin (gross profit divided by revenue) to analyze how efficient a company's operations are.

- Extraordinary items are isolated and shown under the 'non-operating items' head to suggest that they are one-off events and will not recur every period. Thus, a stock analyst can ignore them while valuing a business entity for a potential merger and acquisition scenario.

Disadvantages

- A disadvantage of the multi-step income statement is its preparation, which requires the accountant to classify each expense into the appropriate categories. The accountant also needs to perform multiple calculations to determine each type of income.

- Another disadvantage is that the financial statement user can potentially be confused about the meaning of each level of income.

To recap, the key differences between the single-step and multi-step that are important to note are:

- A single step income statement uses only one step to calculate the net income, i.e. subtract expenses from revenues. Whereas, a multi-step statement uses numerous steps to arrive at the final net income figure

- A single-step income statement shows only net income, whereas a multi-step income statement shows gross profit in addition to net income.

- A single-step income statement is generally used in a services industry. A multi-step statement is used for manufacturing businesses.

- Single-step statements are known to be concise and lacking details. A multi-step statement is more comprehensive.

- A single-step income statement treats the cost of goods sold as expenses. This is not the case in a multi-step income statement.

Income Tax Allocations

Intra-period tax allocation is the process of allocating income tax expense to various categories within the statement of income, comprehensive income, and retained earnings.

For example, income taxes are to be allocated to the following four categories:

- Income from continuing operations before taxes

- Discontinued operations, net of tax

- Each item reported as other comprehensive income, net of tax

- Each item regarding retrospective restatement for changes in accounting policy or correction of prior period errors reported in retained earnings, net of tax, which is also discussed later in this chapter

The purpose of these allocations is to make the information within the statements more informative and complete. For example, Toulon's statement of income for the year ending December 31, 2020, allocates 30% income tax as follows:

- Income from continuing operations of $850,000 ($2,833,000 × 30%)

- Loss from discontinued operations of $45,000 ($150,000 × 30%)

- Loss from disposal of discontinued operations of $18,000 ($60,000 × 30%)

- Comprehensive income gain from FVOCI investments of $6,000 ($20,000 × 30%)

All companies are required to report each of the categories above net of their tax effects. This makes analyses of operating results within the company itself and of its competitors more comparable and meaningful. Accounting entries related to income tax will be covered in the next accounting course (Intermediate Accounting 2).

Note: if there is a net loss, the income tax reported on the income statement will be "income tax recovery" and shown as a negative (bracketed) amount.

Discontinued Operations

Sometimes companies will sell or shut down certain business components or operations because the operating segment or component is no longer profitable, or they may wish to focus their resources on other business components. To be separately reportable as a discontinued operation in the statement of income, the business component being discontinued must have its own clearly distinguishable operations and cash flows, referred to as a cash-generating unit (CGU) for IFRS companies. Examples are a major business line or geographical area. If the discontinued operation has not yet been sold, there must be a formal plan in place to dispose of the component within one year and to report it as a discontinued operation.

When preparing the income statement (or statement of comprehensive income) it's important to note that discontinued operations amounts should be reported net of tax. That means after tax.

If a company has discontinued operations on the income statement, that usually implies that the company will have assets held for sale. Assets held for sale appears on the statement of financial position (balance sheet). If a discontinued operation that represents a component is not yet disposed of there a several conditions that must be met in order to be included in the assets held for sale and then discontinued operations. Assets considered to be held for sale when all of the following conditions are met:

- There is an authorized plan to sell.

- The asset is available for immediate sale in its current state.

- There is an active program to find a buyer.

- Sale is probable within one year.

- The asset is reasonably priced and actively marketed.

- Changes to the plan are unlikely.

In summary, for accounting purposes, assets may be considered as held for sale when there is a formal plan to dispose of the segment. This ensures that only assets for which management has a detailed, approved plan for disposal get measured and is presented as held for sale.

It should also be noted that since the assets are discontinued, no depreciation is taken on the assets since they are not actively used in generating income. Discontinued operations are presented separately on the statement of income or comprehensive income and also on the statement of cash flows.

The items reported in this section of the statement of income are to be separated into two reporting lines:

- Gains or losses in operations prior to disposal of the CGU, net of tax, with tax amount disclosed

- Gains or losses in operations on disposal of the CGU, net of tax, with the tax amounts disclosed

Net Income and Comprehensive Income

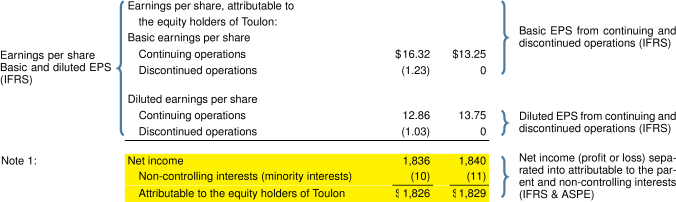

Note that the statement for Toulon Ltd. (shown earlier in the chapter) combines net income and total comprehensive income. Two statements would be prepared for IFRS companies that prefer to separate net income from comprehensive income. The statement of income ends at net income (highlighted in yellow). A second statement, called the statement of comprehensive income, would start with net income and include any other comprehensive income (OCI) items. The Wellbourn financial statement (shown in section 3.3 of this chapter) is an example of separating net income and total comprehensive income into two statements.

Another item that is important to disclose in the financial statements is the non-controlling interest (NCI) reported for net income and total comprehensive income. This is the portion of equity ownership in an associate (subsidiary) that is not attributable to the parent company (Toulon, in our example) that has a controlling interest (greater than 50% but less than 100% ownership) in the acquired company's net assets. Toulon must consolidate the associate's financial data with its own and report as a single entity to comply with IFRS standards. Consider that if a company purchases 80% of the net assets of another company, the remaining 20% must therefore be owned by outside investors. This 20% amount must be reported as the non-controlling interest to ensure that investors and creditors of the company holding 80% (parent) are adequately informed about the true value of the net assets owned by the parent company versus outside investors.

For ASPE companies using a multiple-step format, the statement of income would look virtually the same as the example for Toulon above and would include all the line items up to the net income amount (highlighted in yellow). As previously stated, comprehensive income is an IFRS concept only; it is not applicable to ASPE.

Earnings per Share

Many users of financial information focus on the Earnings per Share (EPS) number as a key indicator of the company's performance. While EPS provides significant information, it does not tell the whole story. Basic earnings per share represent the amount of income attributable to each outstanding common share, as shown in the calculation below:

Basic earnings per share (EPS) = (Net income − preferred dividends) ÷ Weighted average number of common shares outstanding

As an example:

Net Income for a company is $110,000; there are 40,000 common shares issued and outstanding; there are 10,000 preferred shares issued and outstanding that pay a $1.00 dividend per share.

EPS = ($110,000 – (10,000 x $1.00)) / 40,000

EPS = $2.50

It's important to note that EPS measures the amount of dollars earned by each common share, NOT the dollar amount paid to shareholders in the form of dividends. EPS and dividends paid are usually different. The earnings per share amounts are not required for ASPE companies. This is because ownership of privately owned companies is often held by only a few investors, compared to publicly-traded IFRS companies where shares are held by many investors.

For IFRS companies, basic earnings per share excludes OCI and any non-controlling interests. EPS is to be reported on the face of the statement of income as follows:

- Basic and diluted EPS from continuing operations

- Basic and diluted EPS from discontinued operations, if any

The term basic earnings per share refers to IFRS companies with a simple capital structure consisting of common shares and perhaps non-convertible preferred shares or non- convertible bonds. Reporting diluted earnings per share is required when companies hold financial instruments such as options or warrants, convertible bonds, or convertible preferred shares, where the holders of these instruments can convert them into common shares at a future date. The impact of these types of financial instruments is the potential future dilution of common shares and the effect this could have on earnings per share to the common shareholders. Details about diluted earnings per share will be covered in the next intermediate accounting course.

Source: https://ecampusontario.pressbooks.pub/intermediatefinancialaccounting/chapter/3-4-statement-of-income-and-comprehensive-income/

0 Response to "Income From Continued Operations Realized Gain on Income Statement"

إرسال تعليق